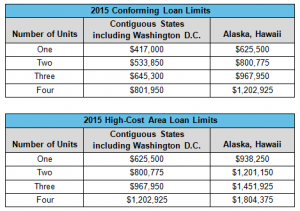

(Here’s a hint: Currently, the only counties in North Carolina or South Carolina with higher limits are Camden, Pasquotank, and Perquimans Counties in NC.)Īnd keep in mind, a larger loan-even a larger conventional loan-means higher payments. Wondering if you live in a high-cost area? Check out the FHFA’s Conforming Loan Limits Map. However, the limit may range between these two limits based on your location. In high-cost areas, the loans can be up to $937,500. While the baseline loan limit in 2022 is $625,000 in most areas, the loan limits do take location into account. Loan limits predetermine the maximum amount most borrowers can borrow under these conventional loans-i.e., what those GSEs will accept. These standards include minimum credit scores, maximum debt-to-income ratios, minimum down payments, and, of course, loan limits. Every mortgage they “buy” must meet their standards, which ensure the loan is stable. However, GSEs don’t just back mortgages willy-nilly. Rather than offer loans themselves, these GSEs purchase mortgages from lenders, then repackage them as mortgage-backed securities for investors. There are government-sponsored enterprises (GSE) that are federally backed mortgage companies that support the country’s home loan market. So what does this conventional loan limit increase mean for your wallet? Read on to find out. The change symbolizes the highest dollar amount increase in a conforming loan limit since 1970, and the new loan limits go into effect in November 2021. That’s an increase of $76,750 compared to the 2021 limit of $548,250. The 2022 conforming loan limit for single-family homes in most markets is $625,000. The Federal Housing Finance Agency (FHFA) recently announced their new conforming loan limits-the highest amount allowed for most conventional loans-and the number is record-breaking in the best way. The rising price of homes isn’t exactly good news for most homebuyers, but it isn’t all bad. According to Forbes, the average price of homes in 2021 will likely increase 14% compared to 2020. It probably won’t surprise you to learn that home prices have been on the rise this year.

0 kommentar(er)

0 kommentar(er)